Central Virginia Short Term Rental Cheat Sheet

Welcome to the world of Virginia’s short-term rental regulations, where every locality has its own flavor of bureaucratic creativity and the acronyms multiply like rabbits. I spent years parsing eighteenth-century sermonic prose—trust me, municipal code is worse.

The terminology below will help you navigate Central Virginia's regulatory landscape without accidentally becoming a cautionary tale in your neighborhood Facebook group.

Central Virginia Short-Term Rental Regulations Frequently Asked Questions

Virginia Short Term Rental Terminology

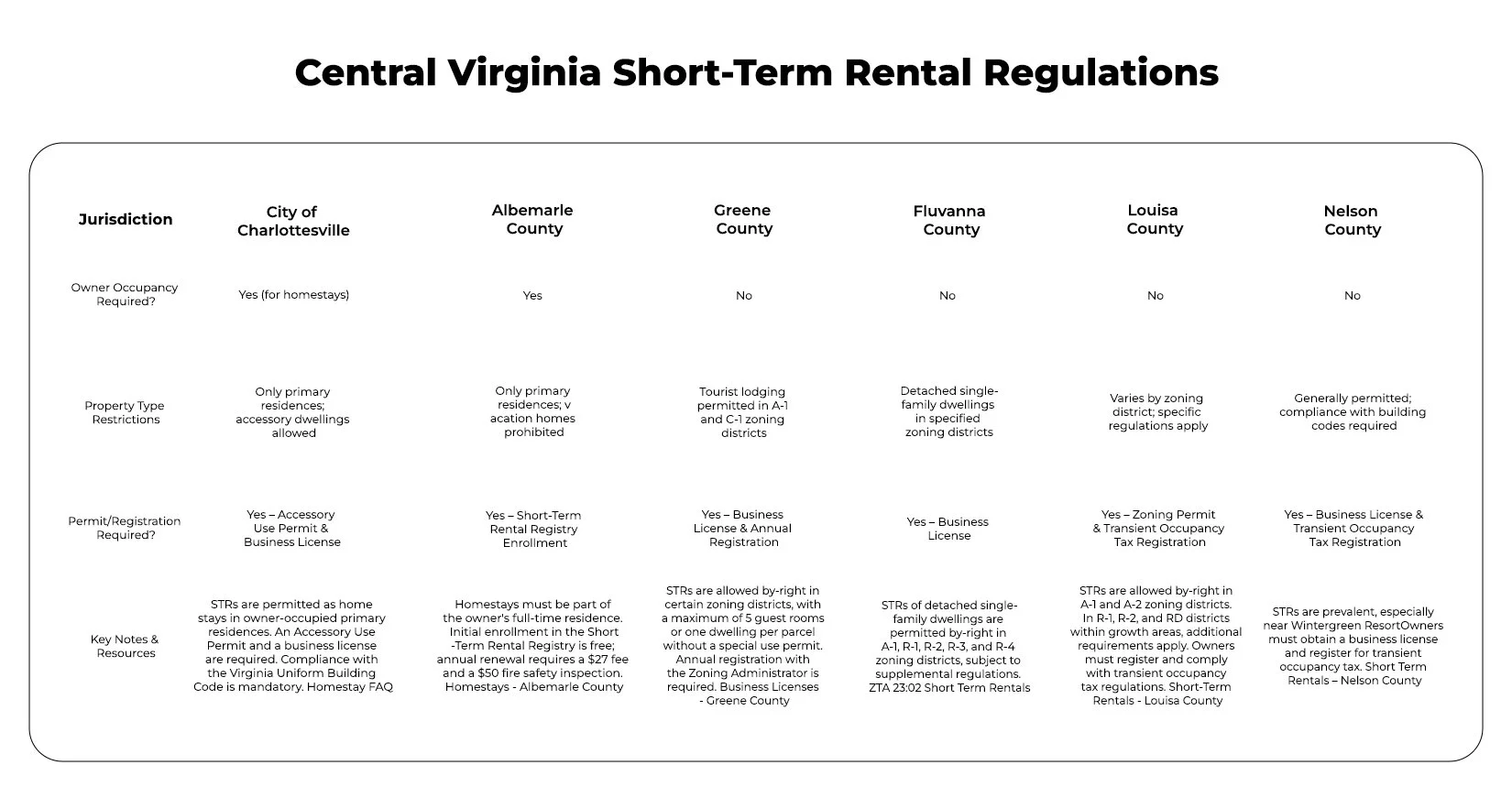

Central Virginia Regulations by County

Central Virginia Short-Term Rental Regulations

Frequently Asked Questions

What Is a Short-Term Rental? - A short-term rental (STR) refers to the rental of a room, dwelling, or space for temporary lodging—typically fewer than 30 consecutive days—in exchange for payment. These arrangements are commonly listed on platforms such as Airbnb, VRBO, and similar services, and are also sometimes referred to as homestays or transient accommodations. (In Charlottesville, these are called “Homestays” and in counties like Nelso)n, you’ll be paying “TOT” or Transient Accommodation Tax”).

Are Short Term Rentals legal everywhere in Virginia? Nope! Some counties set 30 nights as the minimum stays (A “mid-term” rental. Some allow them only within homes, or adjacent buildings on the same lot. Every county is different, and its your responsibility to know the laws applicable to you before you start yours.

This is my home! Can my local government really regulate this? Absolutely. You’re starting a business, and government has the right to regulate all business activities.

What happens if I don’t follow the regulations? Eventually, you’ll be fined and shut down. STR rules are widely enforced all over Virginia.

What Is a Short-Term Rental Registry? - Under Virginia Code § 15.2-983, local governments are permitted to create an official Short-Term Rental Registry. Property owners who rent out spaces on a short-term basis may be required to enroll annually. However, certain professionals, including licensed real estate agents, may be exempt from registration depending on local ordinances.

What Is the "Three Strikes" Rule? - Local jurisdictions in Virginia are authorized by § 15.2-983 to implement a “three strikes” policy. This allows a locality to prohibit a registered STR operator from renting a particular property if the owner commits three or more separate violations of state or local laws or regulations related to short-term rentals.

Do Homeowners Associations (HOAs) Affect Short-Term Rentals? - Yes. While local governments may allow STRs, HOAs or POAs (Property Owners Associations) can override that permission within their communities. Virginia law affirms that recorded covenants, community rules, and private agreements take precedence. For example, Lake Monticello and Belvedere are neighborhoods where STRs are not allowed, even though the county may permit them.

How Are STR Rules Enforced? - Short-term rental rules are generally enforced based on complaints. When a violation is reported, the local Zoning Administrator or their designee investigates to determine if enforcement action is necessary under applicable zoning laws and ordinances. Some cities and counties have employees who monitor rental platforms and identify un-permitted listings for enforcement.

How do I change my local laws? Organize! Join your local Airbnb Host Club or Short Term Rental Association. Tell your story. Work with local elected officials proactively, not reactively. There are many resources available online, and I’ll add links to them soon.

Short-Term Rental Regulatory Terms: A Central Virginia Guide

Charlottesville has rules. Richmond has different rules. The counties? They've got their own ideas entirely.

Here is your survival guide to the terminology that shows up in all their codes, ordinances, and sternly worded permit applications.

Licensing and Registration

Short-Term Rental (STR): A residential property rented for periods of less than 30 consecutive days, typically through platforms like Airbnb or Vrbo.

Business License: A permit required by most localities in Virginia to legally operate a short-term rental business. Requirements vary by jurisdiction.

Zoning Permit: Authorization confirming that short-term rental use is permitted in your property's specific zoning district.

Conditional Use Permit (CUP): A special permit required in some jurisdictions when short-term rentals aren't permitted by-right in a particular zoning district.

Transient Occupancy Tax (TOT): A tax levied on guests staying in short-term accommodations, typically ranging from 5-8% in Central Virginia localities. Sometimes called lodging tax or hotel tax.

Property Classifications

Owner-Occupied STR: A short-term rental where the property owner resides on-site, either in the same unit or on the same property. Many localities have more lenient regulations for this type.

Non-Owner-Occupied STR: A property rented short-term where the owner does not live on-site. Often subject to stricter regulations or higher fees.

Whole-House Rental: The entire residential unit is rented to guests, with no shared spaces with the owner or other tenants.

Homestay: A rental arrangement where guests rent a room or portion of a home while the owner remains present during the stay.

Accessory Dwelling Unit (ADU): A secondary housing unit on a single-family lot, such as a guest house or converted garage, which may be used as a short-term rental subject to local regulations.

Operational Requirements

Life Safety Inspections: Required inspections to ensure the property meets fire and safety codes, including working smoke detectors, carbon monoxide detectors, and fire extinguishers.

Parking Requirements: Minimum off-street parking spaces required per short-term rental unit, typically one to two spaces depending on the locality.

Occupancy Limits: Maximum number of overnight guests permitted based on bedrooms, square footage, or other factors. Common formulas include two persons per bedroom plus two additional guests.

Quiet Hours: Designated times (often 10 PM to 7 AM) when noise must be minimized to respect neighboring properties.

Good Neighbor Policy: A written document outlining house rules and expectations for guests, often required by localities to address noise, parking, trash, and other community concerns.

Local Contact/Responsible Agent: A person designated to respond to issues within a specified timeframe (typically 30-60 minutes) who resides within a certain distance of the property.

Compliance and Enforcement

Certificate of Occupancy (CO): A document certifying that a building complies with applicable building codes and is suitable for occupancy.

Violation Notice: Formal notification from a locality that a property is not in compliance with short-term rental regulations.

Revocation: The cancellation of a short-term rental license or permit due to repeated violations or serious non-compliance.

Cap or Moratorium: A limit on the total number of short-term rental permits issued in a jurisdiction, or a temporary halt on issuing new permits.

Density Restrictions: Rules limiting the concentration of short-term rentals in specific neighborhoods, often expressed as a percentage of total residential units or minimum distance between STRs.

Virginia-Specific Terms

Code of Virginia § 15.2-983: The state statute that grants localities the authority to regulate short-term rentals through taxation and licensure.

Comprehensive Plan: A long-range planning document adopted by localities that may include policies regarding short-term rentals and their impact on housing availability.

Historic District Overlay: Additional regulations that may apply to properties within designated historic districts, common in areas like Charlottesville's downtown.

Homestead Exemption: A property tax relief program for primary residences that may be jeopardized if a property is used extensively for short-term rentals.

Note: Short-term rental regulations vary significantly between localities in Central Virginia. Always verify current requirements with your specific city or county before operating a short-term rental. This glossary is for informational purposes and should not be considered legal advice.

If you are curious about your county’s regulations, the BEST option is to call your county or municipal court house and ask a human.

This is a quickly changing regulatory landscape, and county websites are notoriously out of date.

Call a human, especially one who works in the department of taxes and revenue, and in planning and zoning. Those departments tend to work together to manage an area’s short term rental.

Important Disclaimer:

This table is for informational purposes only and does not constitute legal advice. Regulations are subject to change, and enforcement practices vary. Property owners should confirm current requirements with their local zoning office or speak with a knowledgeable advisor before listing a property as a short-term rental.

N.B. Nelson County’s Short Term Rental regulations are changing in April 2026, and homeowners should contact the county to be fully informed of their responsibilities thereafter.